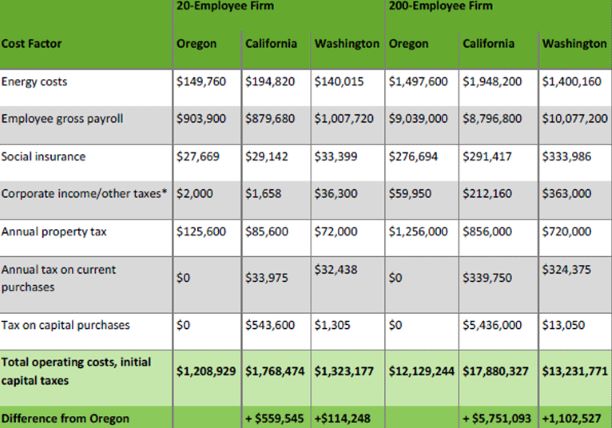

Business Costs

As you consider relocation and expansion, REDI can help you evaluate and compare the cost factors that will impact your business. The table below provides a comparison of typical business cost scenarios in different states for a manufacturing firm with 20 and 200 employees. Visit Comparing Business Costs and Taxes, for additional information, or for a customized comparison tailored to your specific needs, contact us directly.