Why Enterprise Zones Matter

REDI is in the process of renewing its Enterprise Zone program with the State of Oregon for the Greater Redmond area. This program, established by State Legislature in 1975, has been a significant tool in an economic developer’s toolbox ever since.

What is an Enterprise Zone?

By definition, an Enterprise Zone (E-Zone) is an economically depressed area in which business growth is encouraged by the government through tax relief and financial concessions. It is a geographical area with 0% tax on gains from the sale of assets and property sold within the zone. In order to qualify as an E-Zone, an area typically has to meet the State's definition of distress or blight, usually defined as having a relatively high rate of unemployment and/or job loss. Other common criteria include low income or education levels, population decline or high vacancy rate of buildings.

Sponsored by cities, ports, counties, or tribal governments, an Enterprise Zone typically serves as a focal point for local development efforts. There are currently 73 such zones creating opportunities for business investment across Oregon: 56 rural (generally a population of 30,000 or less) and 17 urban. Local governments, or entities like EDCO and REDI are responsible for creating, amending, managing, and renewing most of these zones.

How do Enterprise Zones work?

Enterprise Zones offer qualifying businesses incentives, including property tax abatements and reductions in local development fees.

Oregon's E-Zones are a unique resource and an excellent opportunity for businesses growing or locating in Oregon. The program is one of REDI’s most effective recruitment and expansion tools, which provides qualifying traded-sector companies with tax abatements on certain new real property investments. It is available to new companies who are looking to begin operations or those looking to relocate to the area, but it’s also a valuable tool to those that are already operating here. For a qualifying company, it provides a cost savings during the first years of their investment on items such as new buildings, expansions and renovations and/or production equipment. For a local sponsor (cities and counties), it is a way to attract new investment and jobs with companies that might otherwise choose to locate elsewhere. While there is a short-term cost to the sponsor (typically three years of property tax exemption), there is significant medium and long-term net gain for the community. Learn more about the Greater Redmond Enterprise Zone program by visiting our website: https://rediinfo.com/incentives-tools.

Why does an Enterprise Zone matter to Redmond?

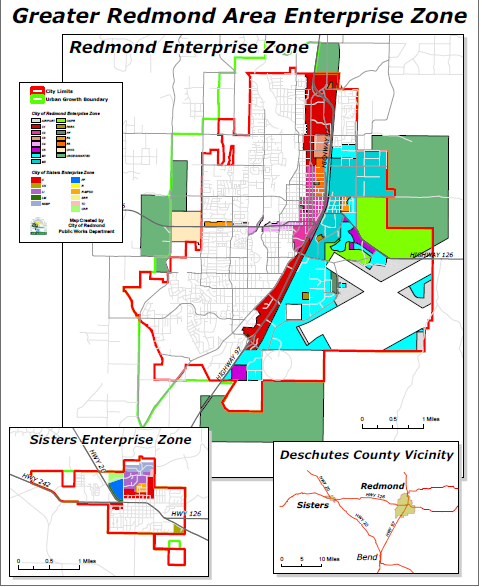

Last renewed in Redmond in 2009, each zone designation lasts 10 years and must be re-designated by application to Business Oregon, the State’s Economic Development agency. First established in Redmond in 1988, the program has assisted 156 companies create 3,373 jobs and invest over $165.5 million dollars in Redmond alone. The re-designation process requires proof that the program is needed and that it has a high probability of success. Redmond’s zone is the most active in the State, with over 36 businesses participating, which has helped increase manufacturing employment by over 70% over the last eight years.

At the December 10th Redmond City Council meeting, Council directed REDI and City Staff to proceed with the application for re-designation (due June 1, 2020). In order to remain competitive with the other 72 zones in the state, Redmond will continue to waive the application fee, and reduce fees for permits, System Development Charges (SDC’s), water and sewer usage, and hook-up fees. An additional benefit that sets Redmond apart is an expedited permitting process.

It isn’t all “rose-colored glasses”, however, as the State Legislature is considering requiring companies participating in the E-Zone to pay prevailing wages for construction of new buildings. If this requirement becomes law, it would render the program useless as it would cost more to pay prevailing wages than the property tax abatement would produce, even over a five-year period. REDI continues to oppose such requirements and will closely follow the next Legislative session, starting in January.

In summary, this program has been invaluable to communities across the State, particularly in Redmond, and we are committed to its renewal.

If you have questions about REDI and the work we do, call 541.923.5223 for more information.